YOUR CREDIT/ DEBIT CARD RECEIPTS CAN LEAD TO YOUR IDENTITY THEFT

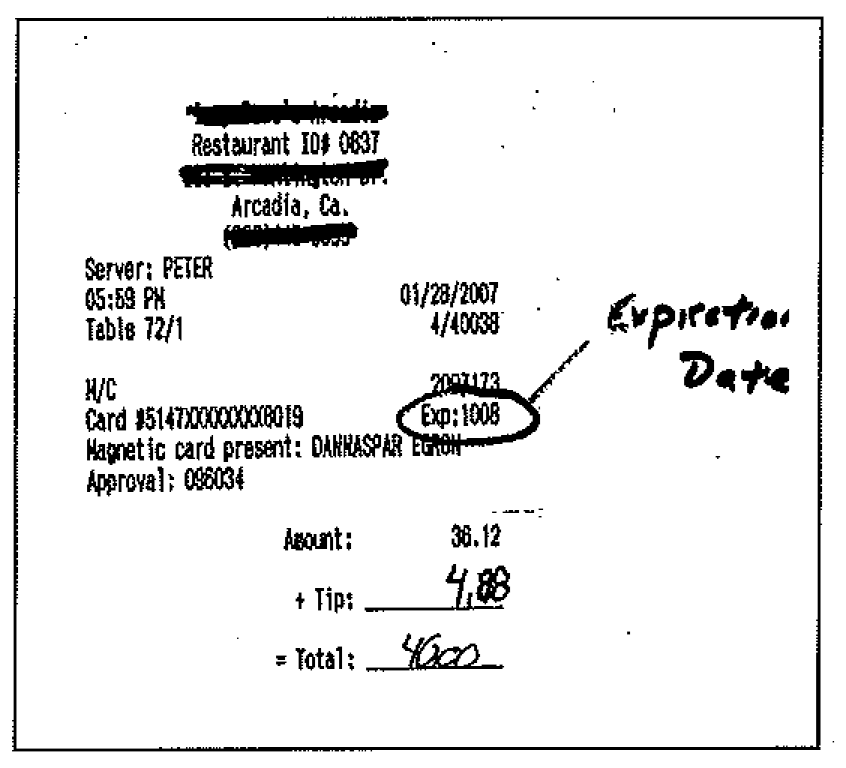

Congress enacted the Fair and Accurate Credit Transactions Act ("FACTA")1 in 2003 as part of a comprehensive, legislative effort to combat identity theft. Section 1681c (g) of the Act states that a business cannot include either 1) more than 4 digits of the credit card number OR the card's expiration date. The most common violation that we see is the expiration date on the credit card. Look at the example on the right:

Congress's rationale was that exposing a customer's name, account number, and expiration date provides too much ammunition

to identity thieves. Congress also authorized statutory damages without requiring proof of actual harm, meaning that consumers are entitled to damages even when they cannot

offer evidence of loss.

Why FACTA?

Why would congress take such a hard stance against printing credit card numbers or expiration dates on customers' receipts? Identity theft is rampant, and there has been a massive failure by merchants to take reasonable actions to protect their customers' personal financial information. Equally important, most receipts are lost or thrown away. Finding a receipt with a credit card number or the card's expiration date is all identity thieves need to pretend to be you. Once your data gets downloaded, the Internet makes it easier for criminals to use or sell it around the world. They can use the information to open bank accounts. in your name buy cars, write bad checks, obtain false identification such as a drivers license issued with their picture and your name, create counterfeit checks, credit or debit cards, and give your name during an arrest. Those facts alone should cause merchants to take notice of FACTA.

Steven L. Miller and Associates are Class Action Experts

For all its merits, a class action lawsuit can be complex. The lawyers must not only master strict procedures but also the many nuances that can shape a legal strategy and guide their clients to success. The right legal counsel can mean victory, vindication, and compensation for the victims.In the wrong hands, a class action lawsuit could mean defeat and produce law that does not protect consumers.

Steven L. Miller has 30 years experience protecting the rights of consumers and employees.Through his class-based litigation efforts, Steven Miller and his associates have obtained tens of millions in damages, together with substantial injunctive relief and other benefits on behalf of thousands throughout California.

If you discover that more than five digits of your credit card number was displayed and the expiration date is visible, save the receipt and obtain any information about the company that is available. The more information you obtain, the better it is to prove your case. Then, contact our office as soon as possible. Chances are you may be entitled to compensation.

If you retain Steven L. Miller a Professional Law Corporation you do not have to pay a cent. He will front all the costs for your case and take all the risks. For a free, no obligation legal consultation, contact Steven L. Miller, a Professional Law Corporation at 855-216-9303.